While the art market is undergoing a significant readjustment to return to pre-pandemic levels, it has notably expanded its base. There are now fewer frenzied races to multi-digit record prices and more transactions in the $10,000-and-under range—a shift that suggests an increasingly democratic and potentially more stable market. These are the key takeaways from the latest report compiled by Artprice, which focuses exclusively on auction results and does not provide a complete picture of the market overall. Still, there’s plenty to unpack here.

The volume of global sales at auction has settled back under the $2 billion threshold, mirroring levels seen before the COVID-era boom. But even in the wake of its pandemic peak, contemporary art remains a central pillar of the global market, now representing more than 17 percent of total value. Its growth over the past two decades has been explosive, leaping from $169 million to $1.888 billion. More significantly, the number of contemporary art transactions has doubled in just the past ten years.

SEE ALSO: Art Basel and UBS Data Show Market Stability Despite Declines in Collector Spending

As during the pandemic, auction houses have now fully embraced online and hybrid sales, increasing the accessibility of contemporary art worldwide. This digital shift has been instrumental in fueling the surge in volume, with 2024 seeing more than 132,000 transactions—a record-breaking figure. According to the report, this growth is being driven primarily by an unprecedented wave of sales at the most accessible price point (under $5,000) as auction houses work to attract a new generation of buyers, particularly Gen Z and Millennials.

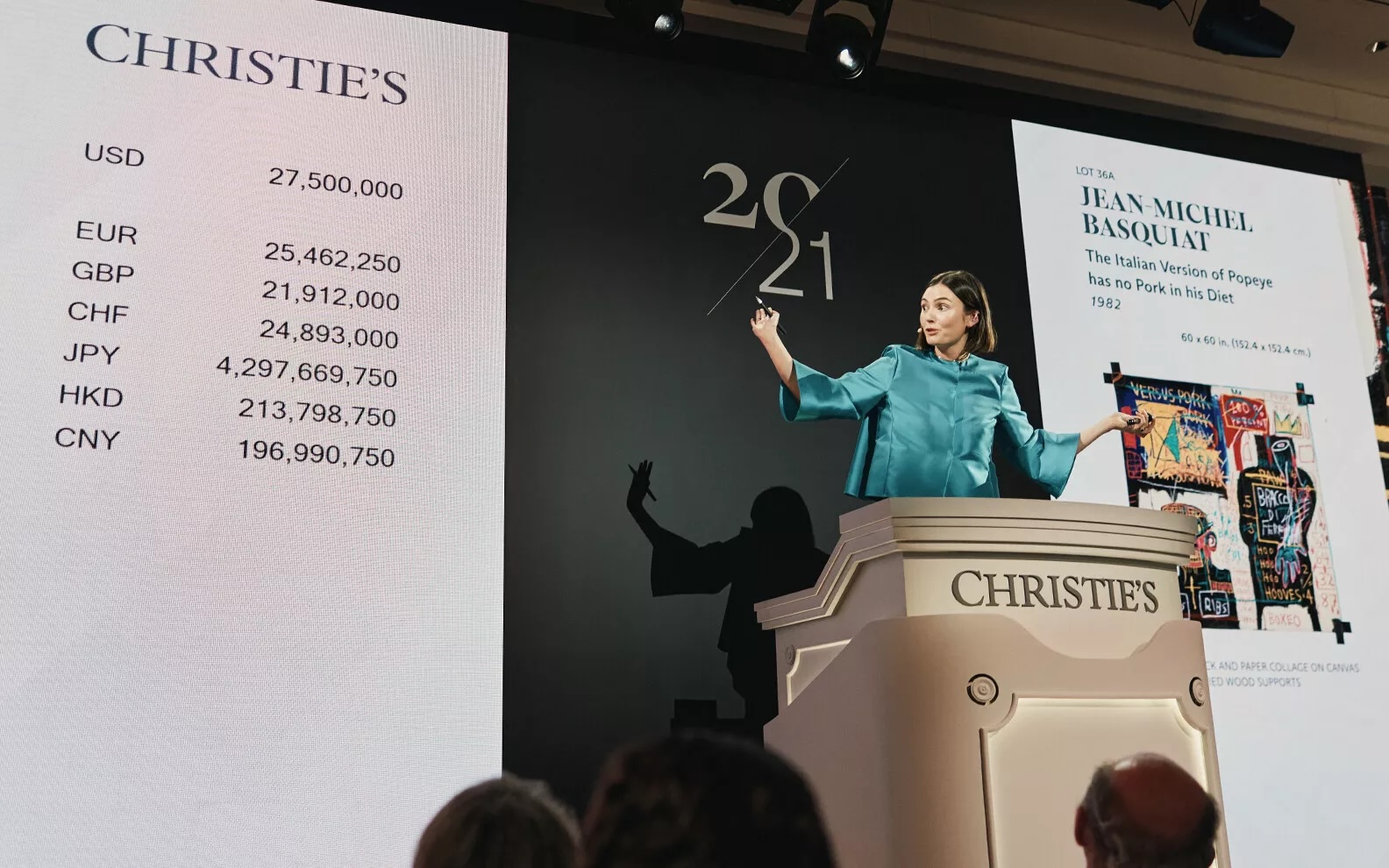

Despite the promise of a more open and decentralized market, turnover remains heavily concentrated at the top. The 500 highest-performing artists alone generated $1.59 billion in sales, accounting for a staggering 84.4 percent of global auction turnover. Still, even in this upper tier, sourcing high-quality lots is becoming increasingly difficult for auction houses. Just last month, Christie’s made headlines by securing the Riggio collection.

As the ultra-contemporary market undergoes a price readjustment, demand holds steady

An ongoing generational transfer of wealth and a shift in aesthetic preferences are also fueling the remarkable rise of the ultra-contemporary sector—defined as artists born after 1974—which grew from $65 million in sales between 2017 and 2020 to a peak of $427 million in 2021/2022, marking a staggering 557 percent increase. During this golden period, 64 works—mostly “fresh-paint” pieces straight from the studios of artists under 40—achieved record-breaking results, each exceeding the half-million mark. As many of these fast-rising stars now face a market correction, auction houses have taken a more cautious approach. To avoid the risk of unsold or underperforming lots, fewer ultra-contemporary names appeared in the year’s evening sales, both in New York and in Hong Kong, where they once dominated. For comparison, only 43 works by ultra-contemporary artists surpassed the $500,000 threshold in the 2023/2024 period.

The data from Artprice aligns with findings from the Artnet Price Database, which reported a 37.9 percent decline in ultra-contemporary sales at auction between 2023 and 2024, following an earlier contraction of 25.1 percent from 2022 to 2023. Still, even as post-pandemic collectors return to a more measured mindset—perhaps less willing to chase sky-high prices for fresh-out-of-MFA artists—demand remains strong. Ultra-contemporary art accounted for nearly $150 million in 2024, representing 8 percent of the total value of the Contemporary art market. Some artists have continued to perform well despite broader cooling, with women making up a dominant portion of today’s top sellers. These include consistent auction stars such as Jadé Fadojutimi, Lucy Bull, Avery Singer, Loie Hollowell, Issy Wood, Christina Quarles and Ewa Juszkiewicz. Only three men—Matthew Wong, Chen Fei and new entrant Mohammed Sami—made it into this year’s top ten for auction turnover, suggesting that the long-contested gender gap is not just narrowing but may now be on the verge of a full reversal.

According to Artprice, this top ten cohort alone generated $59 million in 2024, accounting for 40 percent of the entire ultra-contemporary market. From a geographic and cultural perspective, it’s worth noting that most of these top-performing young artists hail from the U.S., reaffirming the country’s—and New York’s—central role in shaping and promoting new talent. A notable exception is the Polish-born, New York-based Juszkiewicz, whose market soared after she joined the roster at Gagosian. Now one of the most sought-after artists from her country, demand for her paintings alone accounted for 20 percent of Poland’s ultra-contemporary auction revenue last year. Her rise helped propel Poland into the top five global markets for ultra-contemporary art, with national growth in the sector hitting 69 percent in 2023/2024.

The $10,000-50,000 range is the contemporary market’s sweet spot

According to the report, while the $5,000–$10,000 price segment stands out for its stability—accounting for 6 percent of all transactions—the $10,000–$50,000 range remains notably dynamic, comprising 8 percent of the market. More significantly, this bracket now represents a strategic sweet spot where secondary-market collectors can acquire works by established artists who have largely been shielded from the speculative frenzy—and its subsequent crash—and whose careers are grounded in institutional recognition and solid resumes. For example, the market for works by Shilpa Gupta, the internationally renowned Indian artist represented by Hauser & Wirth and with an exhibition history that includes many of the world’s most prestigious institutions, continues to operate within this range. Her work has been particularly affordable on the secondary market this year relative to other peers. In contrast, the segment above the $50,000 threshold is facing real strain—except at the trophy-lot level—suffering a sharp decline, with sales dropping 21 percent compared to the previous year.

New York’s resilience, Hong Kong’s synchronization and the growth of the French and Indian markets

Like many other industries, the art market has reacted to fast-shifting geopolitical and economic dynamics, leading to declining auction turnover totals for contemporary art and the emergence of new global centers. Significant drops were recorded in previously dominant markets like the U.K. and China. With a 26 percent decrease, London’s auctions in 2024 were the lowest seen in a decade. While some notable results and high sell-through rates came from carefully curated, low-risk offerings, last week’s London evening auctions confirmed that the market remains lukewarm in the British capital.

In China, collectors have adopted a far more cautious stance. According to Artprice, this has resulted in a 32 percent decline—though it’s important to note this figure refers only to international houses operating primarily out of Hong Kong, as the database does not include mainland Chinese auction houses such as Poly. Still, despite this context, Hong Kong had a banner year in 2024, reaffirming its regional leadership with the openings of new landmark spaces by Christie’s, Sotheby’s and Bonhams, following Phillips, which had already launched its Asia-Pacific headquarters in 2023 next to the M+ museum.

By contrast, the U.S. market—and specifically the New York auctions—showed resilience, with only a 9 percent decline, which Artprice attributes largely to a softening at the top end. No lots sold above the $50 million mark this year. However, this was offset by a notable increase in volume: the number of lots offered in New York has surged by 150 percent since the pre-pandemic era, reaching a record 41,000 lots in 2024. One phenomenon highlighted by the report is the growing synchronization between New York and Hong Kong auctions, which is establishing a new set of auction stars with aligned recognition and price points on both sides of the globe.

Meanwhile, France had one of its strongest years, generating $62.8 million in total sales—a 33 percent increase from 2023. Reflecting this momentum, Sotheby’s invested in a new luxury headquarters in Paris’ upscale Saint-Honoré district. The inaugural Paris auctions—”Modernités” and the white-glove “Surrealism and its Legacy”—surpassed their combined pre-sale estimates, totaling €60 million ($65 million) last October.

Perhaps more unexpectedly, the Artprice report reveals that the Indian market has also seen significant post-pandemic growth, placing it among the ten most important global art markets. This momentum has been fueled by rising interest, locally and internationally—in key 20th-century Indian artists like Vasudeo S. Gaitonde, Sayed Haider Raza and Tyeb Mehta—interest that was bolstered by their inclusion in Pedrosa’s Venice Biennale. At the same time, the country’s contemporary segment experienced a spectacular 122 percent surge, generating $13.4 million in sales.

Taken together, the Artprice report presents a more nuanced and less dire portrait of the current art market than some might have anticipated. It ultimately underscores the resilience of the contemporary sector—and even more so of the ultra-contemporary segment—which, after booming under the extraordinary conditions of the pandemic, continues to benefit from consistent demand.

What we are witnessing now is not collapse but a long-overdue price—and reality—check for the market. The hope is that this recalibration will pave the way for greater stability, while also expanding access through new technologies, new buyers and new regional hubs that are already playing a vital role in making the global art ecosystem more democratic and sustainable.

<